The Kano State Internal Revenue Service (KIRS) has commended the Tax Justice and Governance Platform, Kano (TJ&GP) for its invaluable assistance in improving tax administration in the state.

The service made this commendation at the KIRS headquarters on Friday.

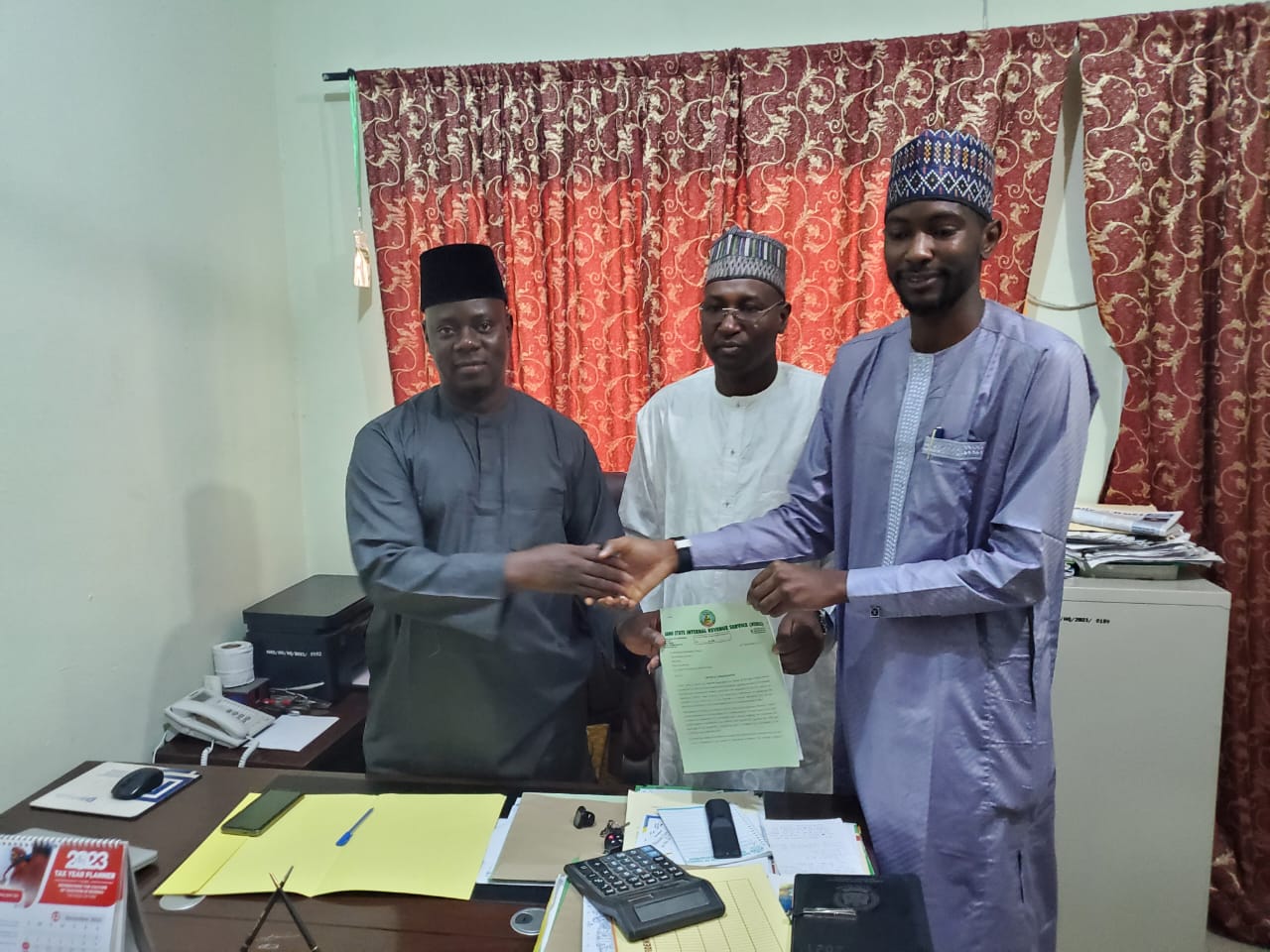

Sammani Ibrahim, Director of governance and business, KIRS, while honoring Tax Justice with the letter of appreciation, lauded the platform’s contributions.

“Today we are here to present a letter of appreciation to tax justice for their numerous contributions throughout this year,” he said.

“TJ& GP has helped in a lot of areas including organizing radio programs where KIRS directors were invited, capacity building workshops for KIRS staffs, facilitating dialogues between revenue generation agencies and taxpayers associations and the KIRS among others.

“They also contribute suggestions and recommendations, which we mostly consider and adopt.”

According to him, the purpose is to address grievances and strengthen the tax system in the state.

The director added that, “this in turn has helped improve the service significantly.

“Due to radio programs organized by TJ&GP, more taxpayers now understand the tax systems and are more willing to pay.”

He assured the KIRS’s openness to future collaborations.

Sadiq Muhammad Mustapha, the program lead of TJ&GP expressed gratitude during his speech.

He expressed appreciation to KIRS for acknowledging Tax Justice, recognizing the efforts invested in supporting the service to achieve its objectives, and deeming them worthy of a recommendation.

“This is a collaboration that has come to stay. As I mentioned earlier, Tax Justice is committed towards ensuring that tax justice and fiscal transparency is achieved in the state as well as increasing revenue mobilization.

“And KIRS is a leading institution that we are willing to continue collaborating with to enhance tax administration in Kano State, ensuring strengthened processes to increase tax mobilization within the state.”